Understanding Token Distribution in DeFi

What is Token Distribution?

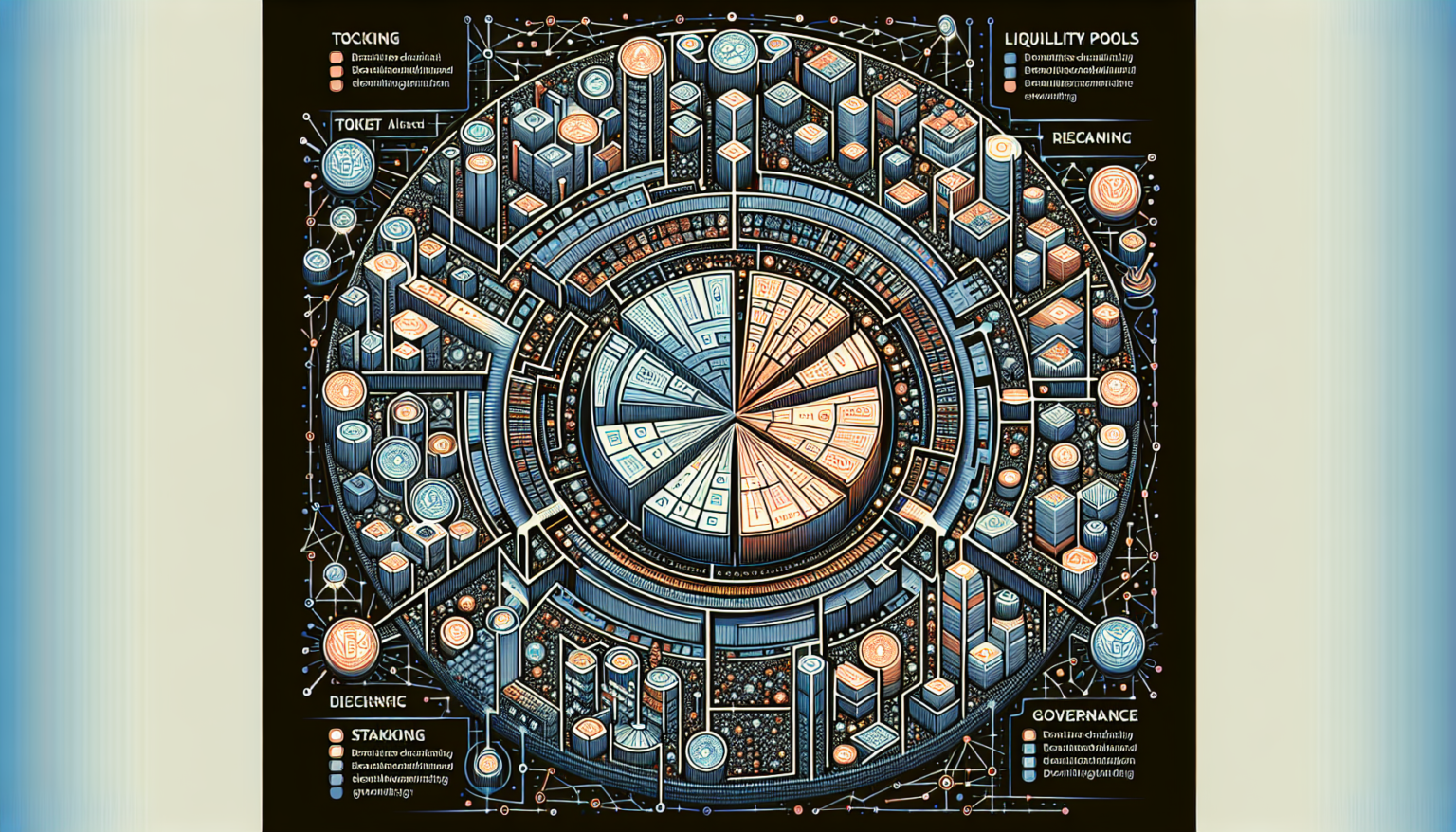

Token distribution in decentralized finance (DeFi) projects refers to the method and strategy used to allocate tokens among various stakeholders. This can include investors, developers, community members, and liquidity providers. The way tokens are distributed can significantly influence a project’s success, governance structure, and overall health of the ecosystem.

Importance of Effective Token Distribution

Implementing an effective token distribution strategy is crucial for several reasons. First, it aligns the interests of various stakeholders, helping ensure that everyone is motivated to contribute positively to the project. Second, a well-planned approach can create a sense of community and enhance user adoption. Finally, proper distribution can help mitigate risks such as centralization or market manipulation.

Types of Token Distribution Models

Initial Coin Offerings (ICOs)

ICOs were one of the first methods of token distribution in the crypto space. They allow projects to raise capital by selling tokens directly to investors before a project launches. This model often involves a timed sale where early adopters can buy tokens at a lower price.

Benefits of ICOs

ICOs can attract large sums of money quickly and provide liquidity right from the start. Additionally, they create buzz around a project and can lead to a community of invested individuals.

Drawbacks of ICOs

However, ICOs have faced criticism for being prone to scams and for attracting speculative investments. Moreover, without proper regulation, projects can disappear after raising funds, leaving investors high and dry.

Initial DEX Offerings (IDOs)

IDOs have gained popularity in the DeFi space. They involve launching tokens directly on decentralized exchanges, allowing users to buy tokens without the need for a centralized authority.

Benefits of IDOs

IDOs provide immediate liquidity and can be more accessible for users interested in participating. They also tend to enable a fairer distribution of tokens as users can buy directly from a decentralized platform.

Drawbacks of IDOs

On the downside, IDOs can be overwhelmed by demand, leading to issues like front-running and increasing volatility shortly after launch, which can deter some potential investors.

Liquidity Mining and Yield Farming

In the DeFi ecosystem, token distribution often happens through liquidity mining and yield farming. In these scenarios, users provide liquidity to a platform, and in return, they earn tokens as rewards.

Benefits of Liquidity Mining and Yield Farming

These mechanisms encourage user participation and help grow liquidity on decentralized exchanges. They also provide an incentive for users to hold onto their tokens, promoting stability.

Drawbacks of Liquidity Mining and Yield Farming

Liquidity mining can lead to “vampire attacks,” where a new project incentivizes liquidity providers to move from one protocol to another, potentially harming the original project. Additionally, the emphasis on token rewards can sometimes overshadow the project’s core value.

Key Factors in Token Distribution Strategy

Total Supply and Distribution Timeline

The total supply of tokens and the distribution timeline are essential components to consider. A finite supply can create scarcity, potentially increasing the token’s value over time. However, distributing too many tokens too quickly can lead to inflation and devaluation.

Token Vesting Periods

Implementing vesting periods locks up tokens for a predetermined time, preventing immediate selling. This technique encourages long-term commitment among team members and early investors, helping to stabilize the token price.

Community Involvement and Governance

Decentralized projects often incorporate community governance, giving token holders a voice in development decisions. The distribution of tokens can directly impact community engagement, as those with more tokens usually have greater influence.

Participating in Governance

Engaging the community in governance decisions can strengthen the project. Voting on key proposals or changes keeps users invested in the project’s future and fosters a sense of ownership.

Incentives for Early Adopters

Offering incentives for early adopters can boost interest and encourage initial investments. This can include bonus tokens during the initial sale or special privileges in governance decisions.

Strategies for Engagement

Creating rewards for community participation, such as airdrops or referral bonuses, builds a vibrant ecosystem. These incentives can enhance user loyalty and ensure a broad base of supporters.

Challenges in Token Distribution

Market Manipulation Risks

A poorly executed token distribution can lead to market manipulation issues. If a significant amount of tokens is held by a few individuals or entities, it can result in erratic price changes and lead to distrust among investors.

Strategies to Counter Manipulation

Using mechanisms like distribution caps or encouraging wider participation can help mitigate risks associated with concentration. A diverse distribution leads to a healthier, more balanced market.

Regulatory Compliance

With growing scrutiny from regulators, ensuring compliance with securities laws and other regulations is vital. Failure to do so can lead to legal repercussions and damage the project’s reputation.

Building Transparency and Legitimacy

Maintaining clear communication and transparency about the project, including its tokenomics, can enhance credibility. Providing detailed documentation and regular updates reassures users about the project’s integrity.

Long-term Sustainability

Sustainability is a key concern for any token distribution model. Projects need to consider how tokenomics will evolve over time, ensuring they will remain viable and attractive to users beyond the initial launch phase.

Evaluating Community Engagement Over Time

Tracking community engagement metrics can help projects gauge their sustainability. Understanding how tokens are being used and the level of activity can inform future decisions and modifications.

Case Studies in Token Distribution

Successful Token Distribution Examples

Learning from successful DeFi projects gives insights into effective distribution strategies. Projects like Uniswap or SushiSwap employed liquidity mining and community governance successfully, leading to high user engagement and loyalty.

Uniswap’s Community Governance

Uniswap’s decision to distribute governance tokens to liquidity providers gave them a stake in decision-making, drastically increasing community involvement.

Lessons from Failed Token Sales

Conversely, examining failed projects can highlight risks associated with poor token distribution. These cautionary tales often emphasize prioritizing transparency, fair allocations, and sustainable practices.

Highlighting Common Missteps

Many unsuccessful projects made the mistake of concentrating token holdings among founders or early investors. Consequently, they struggled to build a loyal user base or endure market volatility.

In summary, understanding token distribution in DeFi is multifaceted and essential for the long-term success of projects. By exploring different methods and learning from existing examples, teams can better strategize their distribution to foster growth, community, and sustainability.