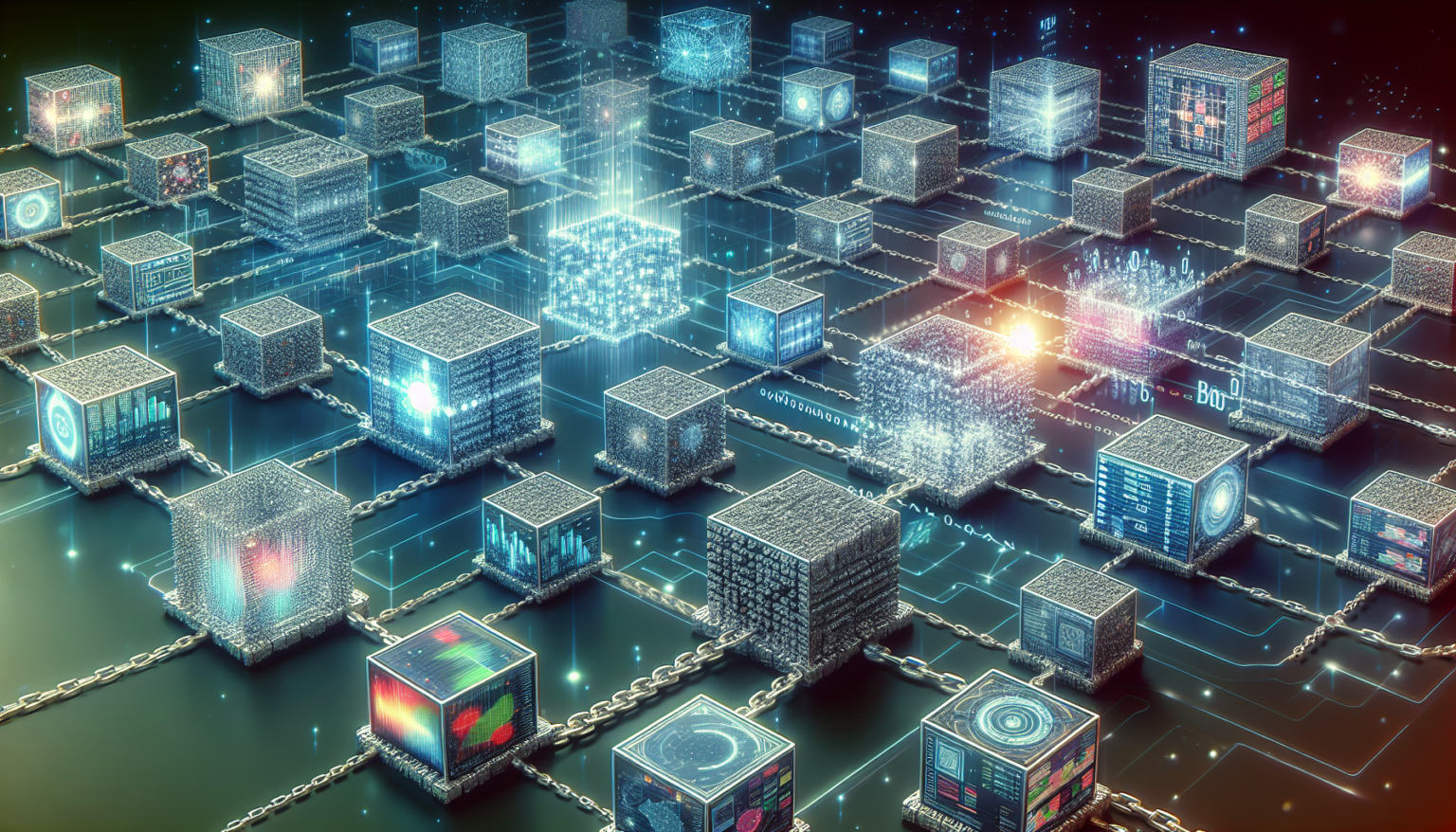

Understanding Blockchain in Finance

Blockchain technology has fundamentally changed various sectors, but its most notable impact appears in finance. Here, we delve into the multiple use cases of blockchain in finance to provide a clearer understanding of its potential and challenges.

Peer-to-Peer Transactions

What Are They?

Peer-to-peer (P2P) transactions eliminate the need for intermediaries, such as banks or financial institutions, allowing individuals to transact directly. This is made possible by blockchain, where every transaction is recorded on a decentralized ledger.

Pros and Cons

Advantages

One of the main advantages of P2P transactions is the speed; they can occur almost instantaneously. Additionally, transaction fees are significantly reduced because there’s no middleman.

Disadvantages

However, the lack of regulation can lead to fraud and other illicit activities. In some jurisdictions, P2P transactions may face legal issues, which could deter users.

Decentralized Finance (DeFi)

What Is DeFi?

Decentralized Finance is a financial ecosystem built on blockchain technology. It provides various services traditionally offered by banks through smart contracts, enabling things like lending, borrowing, and trading without the need for central control.

Pros and Cons

Advantages

One of the standout benefits of DeFi is accessibility. Anyone with an internet connection can participate, regardless of their financial history. It also allows users to retain control of their assets.

Disadvantages

On the downside, the DeFi space is highly volatile, and the lack of regulations can make it a risky venture. Furthermore, since smart contracts are programmed, bugs or vulnerabilities can lead to substantial financial losses.

Cross-Border Payments

The Challenge of Traditional Systems

Traditional cross-border payments can be time-consuming and expensive due to the involvement of multiple banks and conversion fees. Blockchain technology offers a solution to these long-standing issues.

How Blockchain Solves These Issues

Blockchain allows real-time settlements, often within minutes, drastically reducing both time and costs. Using cryptocurrencies instead of fiat currency can also sidestep many conversion and transaction fees.

Case Study: Ripple

One notable player in this space is Ripple, which aims to make international payments more efficient using its XRP token. Numerous institutions have begun adopting this technology, demonstrating its potential efficacy.

Tokenization of Assets

What Is Tokenization?

Tokenization involves converting physical assets—like real estate, art, or commodities—into digital tokens on a blockchain. This process makes these assets more accessible to a wider audience.

Benefits of Asset Tokenization

Increased Liquidity

By tokenizing assets, they can be divided into smaller units, allowing for fractional ownership. This democratizes access and increases liquidity since more people can invest in high-value assets.

Transparency

Blockchain’s immutable ledger ensures all transactions are transparent and traceable, offering a higher level of security compared to traditional methods.

Challenges in Tokenization

While the benefits are significant, challenges remain. Regulatory frameworks surrounding tokenized assets are still evolving, creating uncertainty for investors. Additionally, establishing trust in digital tokens can be more complicated than for physical assets.

Supply Chain Financing

Why It Matters

In the world of finance and trade, efficient supply chain management is crucial. Issues like delays, fraud, and lack of transparency can stall financial operations.

Blockchain’s Role in Supply Chains

Blockchain streamlines the supply chain process by providing a tamper-proof record of transactions. This not only increases transparency but also speeds up payment processes.

Benefits for Businesses

With enhanced tracking of goods from manufacturer to retailer, companies can optimize their inventories and reduce costs, ultimately impacting their bottom line positively.

Real-World Example: IBM and Maersk

A partnership between IBM and Maersk demonstrates how blockchain can enhance supply chain financing. Their blockchain platform, TradeLens, improves visibility and efficiency while reducing paperwork and time frames.

Regulatory Compliance and Reporting

The Importance of Compliance

In finance, regulatory compliance is incredibly important. Institutions must report transactions to ensure integrity and to prevent illicit activities such as money laundering.

How Blockchain Enhances Compliance

Blockchain’s decentralized nature and transparency allows financial institutions to easily access transaction histories, making it far easier to monitor compliance. This can lead to reduced costs related to audits and regulatory fines.

Audit Trails

Each transaction on the blockchain leaves an immutable record, which can serve as an audit trail. This improves the reliability of reports and facilitates better governance within institutions.

Initial Coin Offerings (ICOs) and Fundraising

What Are ICOs?

Initial Coin Offerings are a form of fundraising using cryptocurrencies. They allow startups to raise capital by offering new tokens in exchange for established cryptocurrencies like Bitcoin or Ethereum.

The Advantages of ICOs

ICOs have the potential to raise significant capital relatively quickly, allowing innovators to bring their ideas to market with fewer barriers. They also provide early access to potential investors looking to get in on the ground floor.

The Risk Factors

However, the ICO market has also encountered criticism due to scams and the lack of regulation, putting investors at substantial risk. It’s crucial for potential investors to thoroughly research before participating.

Cryptocurrency Trading

The Rise of Crypto Exchanges

As cryptocurrencies gain popularity, trading platforms have proliferated. These exchanges allow users to buy, sell, and trade various cryptocurrencies.

The Role of Blockchain in Trading

Blockchain technology underpins these exchanges, ensuring secure and transparent transactions. This has led to increased trust and a user-friendly experience in trading.

Market Volatility

However, the cryptocurrency market is known for its volatility. Investors can face significant gains or losses in a short time frame, making it essential to approach crypto trading with caution.

Leveraging Trading Data

Advanced trading algorithms can analyze blockchain-generated data to identify trends and patterns, enabling traders to make informed decisions. This has led to a surge in hedge funds and other institutional investors entering the crypto space.

Conclusion and Future Prospects

While we’ve explored various blockchain use cases in finance, there’s no denying that this technology is still evolving. It has the potential to revolutionize how we think about financial transactions, but understanding both the opportunities and challenges is key.