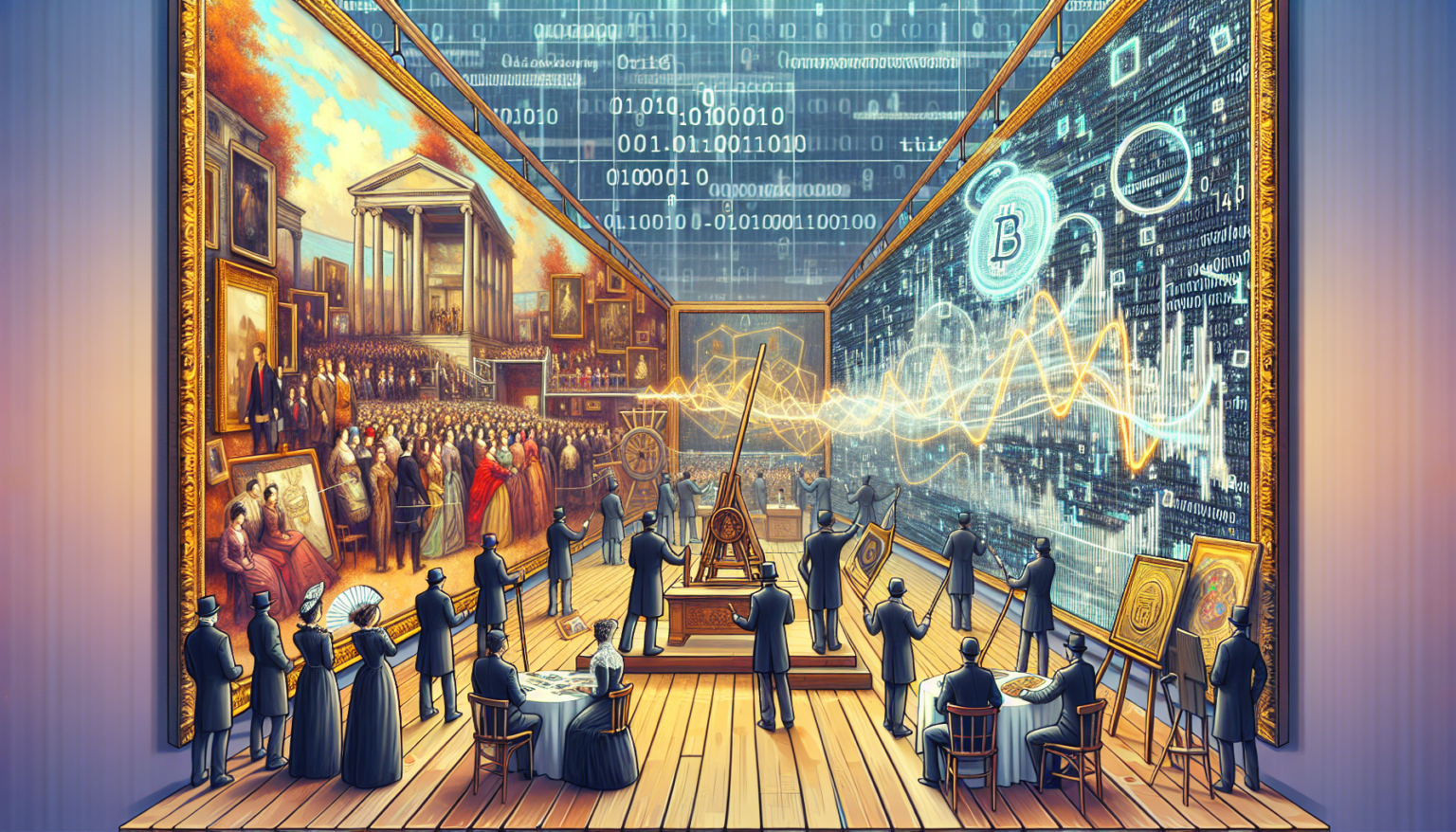

The Emergence of RWA Tokenization in the Art Market

The art market has long been characterized by its exclusivity and complex valuation processes. However, the rise of Real-World Asset (RWA) tokenization is rapidly transforming this landscape, enabling more transparency, liquidity, and access for both artists and collectors. RWA tokenization involves converting physical assets, like artworks, into digital tokens on a blockchain. This process not only provides a new method of buying and selling art but also rekindles interest in how we perceive ownership and value in this sector.

How RWA Tokenization Works

The Basics of Tokenization

RWA tokenization involves a few key steps. First, an artwork is assessed and verified by experts to establish its authenticity and value. Next, a smart contract is created on a blockchain platform, representing the artwork and defining the asset’s characteristics, such as ownership rights, provenance, and any fractional ownership possibilities. Finally, the digital token is minted and can be traded, bought, or sold.

The Role of Smart Contracts

Smart contracts are at the heart of this tokenization process. These self-executing contracts contain the terms of the agreement directly written into code, ensuring that transactions are secure, transparent, and automated. For instance, when an artwork changes hands, the smart contract automatically updates the ownership on the blockchain. This reduces the risk of fraud and errors, which are significant concerns in traditional art transactions.

Benefits of RWA Tokenization in the Art Market

Increased Accessibility

One of the most significant changes brought by RWA tokenization is the democratization of the art market. Traditionally, only affluent individuals could afford to invest in high-value artworks. Tokenization allows for fractional ownership, enabling multiple investors to own a share of a priceless piece. This opens the art market up to a broader audience, allowing more people to participate in what was once an exclusive realm.

Enhanced Liquidity

Liquidity in the art market has always been a challenge. Traditional art sales can take a long time, often involving lengthy negotiations and significant buyer and seller risks. With RWA tokenization, artworks can be traded on digital marketplaces 24/7. This increased liquidity means that artworks can be turned into cash more quickly than ever before, making art a more fluid investment.

Provenance and Validation

Provenance, or the history of ownership of an artwork, is critical in the art market. It can determine an artwork’s value and authenticity. With RWA tokenization, the entire provenance can be recorded on the blockchain in an immutable manner. This offers a transparent and easily verifiable history for each piece, greatly reducing the chances of forgery and enhancing buyers’ confidence.

Real-world Case Studies

Fractional Art Ownership Platforms

Several platforms have begun to leverage RWA tokenization to create fractional ownership models. For instance, platforms like Masterworks allow investors to buy shares of multimillion-dollar artworks. Users can purchase tokens representing a fraction of a high-value piece. This model not only democratizes art investment but has also performed impressively, with many artworks appreciating significantly in value over time.

Digital Art and NFTs

Though distinct from traditional artworks, the rise of Non-Fungible Tokens (NFTs) greatly complements RWA tokenization. NFTs serve as a digital certificate for ownership of a specific piece of digital art. While some may argue that this is different from traditional art forms, the underlying principles of tokenization remain the same. Artists can sell their work directly to collectors without needing intermediaries, allowing them to retain more of the profits.

Challenges Facing RWA Tokenization

Legal and Regulatory Hurdles

While RWA tokenization offers exciting possibilities, it is not without its challenges. One significant hurdle is the regulatory landscape. Different countries have varying laws concerning digital assets, and the art market lacks a standardized regulatory framework. This can create complications for platforms trying to tokenize artworks, including compliance with local laws and managing tax implications.

Market Education

Another challenge is market education. For many traditional art collectors and investors, the concept of tokenization, blockchain, and smart contracts can be daunting. The art market has relied on established practices for centuries, and introducing new technology requires a paradigm shift. Stakeholders in the industry must invest time and resources in education to foster more significant adoption of RWA tokenization.

The Future of RWA Tokenization in the Art Market

Integration with Traditional Art Institutions

As the art market continues to evolve, we may see increased collaboration between traditional art institutions, such as galleries and auction houses, and RWA tokenization platforms. Galleries could start listing tokenized artworks alongside physical pieces, creating a hybrid experience that attracts both tech-savvy investors and traditional art lovers.

Broader Adoption by Artists

Artists stand to benefit tremendously from RWA tokenization. As more artists learn about the benefits of tokenization, including retaining more control over their work and receiving fair compensation, we may see a growing number choosing to tokenize their artworks. This could lead to a surge in new digital marketplaces specifically catering to artists and their creations.

Continued Innovation in Technology

The technology behind RWA tokenization is still in its infancy, and ongoing innovations are expected to refine the process further. As systems become more user-friendly and efficient, it’s likely that more investors and creators will enter the space. These developments could lead to the creation of entirely new business models in the art market.

Conclusion: Embracing the Change

The tokenization of real-world assets, particularly in the art market, represents a significant shift in how we view ownership, value, and investment. While challenges remain, the advantages of increased accessibility, liquidity, and transparency present a compelling case for wider adoption. As stakeholders in the art world navigate this new landscape, it is clear that RWA tokenization is not just a passing trend; it is a transformation that could redefine the entire art market.