Understanding Tokenization in the Art World

What is Tokenization?

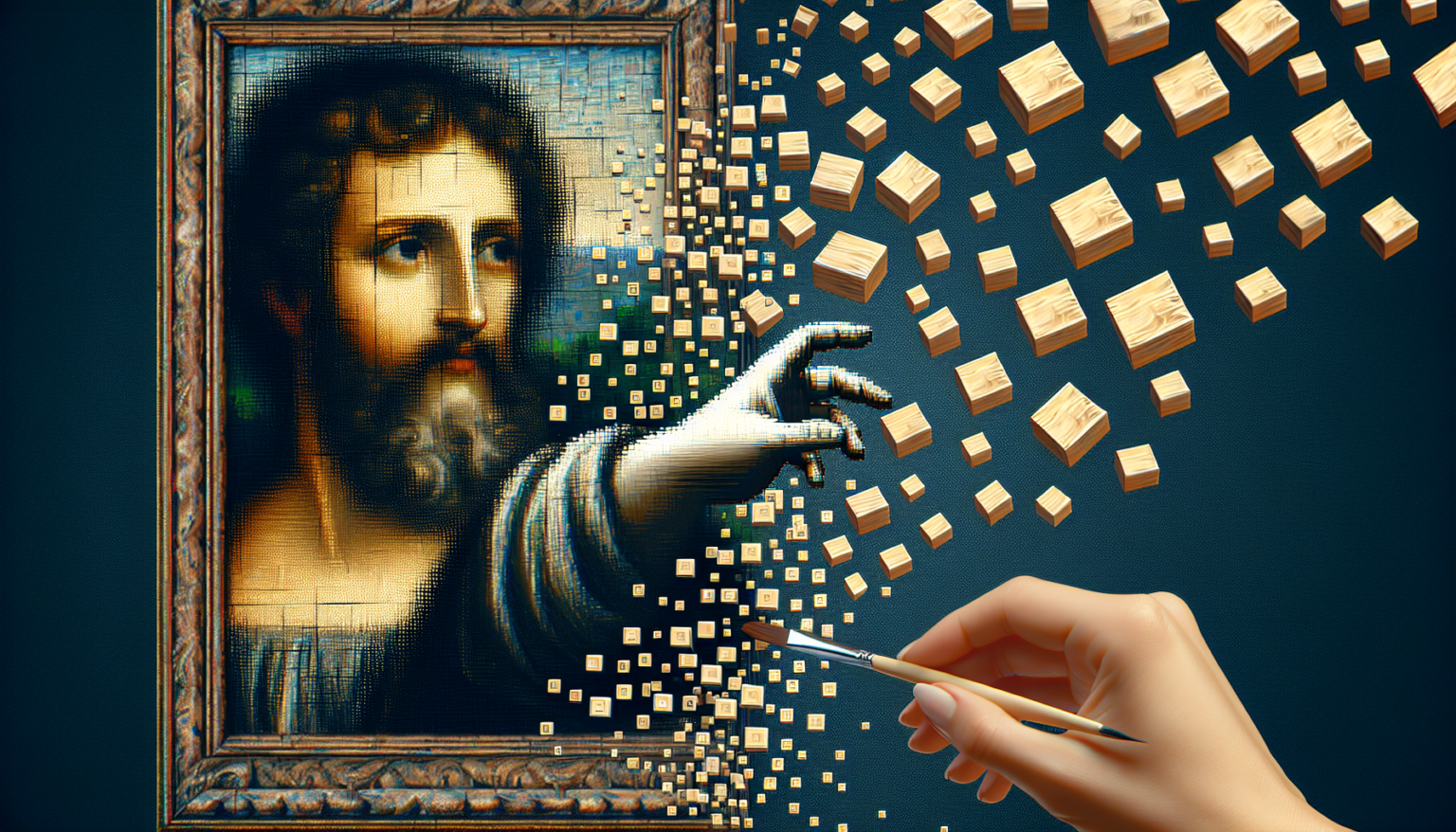

Tokenization refers to the process of converting rights to an asset into a digital token on a blockchain. In the context of artwork, this means creating a digital representation of an artwork that can be bought, sold, and traded on various platforms. Each token serves as a unique identifier, signifying ownership and authenticity of the piece.

Why Tokenization Matters

Traditional art ownership can be cumbersome. High costs, exclusivity, and issues surrounding provenance make it difficult for new collectors to enter the market. Tokenization breaks down these barriers, allowing more people to invest in art and providing artists with new avenues for revenue.

Real World Assets (RWA) and Their Role in Art Tokenization

What are Real World Assets?

Real World Assets, or RWAs, are tangible and verifiable assets that exist in the physical world, such as real estate, commodities, or, in this case, art. By linking these assets to digital tokens, RWAs allow for an easier transfer of ownership and verifiable authenticity.

Connecting RWAs to Digital Tokens

When an artwork is tokenized as an RWA, a portion of its value is fractionalized into smaller, more affordable units. Each unit can be owned by multiple people, widening access to investments in artworks that previously may have been out of reach. This makes art not only an asset but also a shared experience.

The Mechanics of Art Tokenization

Creating a Tokenized Artwork

To create a tokenized version of an artwork, the artist or owner typically goes through a few key steps:

1. Valuation

The first step involves determining the artwork’s market value through appraisal or comparison with similar pieces. This value forms the basis for how many tokens will be issued.

2. Fractionalization

Once the value is established, the total value is divided into tokens. For instance, if a painting is worth $100,000 and is fractionalized into 10,000 tokens, each token represents 1/10,000th of the artwork.

3. Minting Tokens

The fractionalized tokens are then minted onto a blockchain. This process involves creating the digital tokens that will represent ownership in the art piece.

4. Establishing Provenance

One of the key benefits of tokenizing art is the ability to establish and maintain provenance. The blockchain serves as a permanent record of ownership and transaction history, which adds to the artwork’s value and legitimacy.

Benefits of Tokenization for Artists and Collectors

For Artists

Tokenization opens up new revenue streams for artists. By selling fractional ownership of their work, they can reach a broader audience and generate income even after the initial sale.

1. Repeat Sales

When an artwork is tokenized and sold as fractional shares, artists can often earn royalties from secondary sales, similar to the music industry’s model.

2. Greater Exposure

Having art on a tokenized platform increases visibility. New collectors may discover works they might otherwise overlook in traditional galleries.

For Collectors

For collectors, tokenized art presents unprecedented opportunities:

1. Access to High-Value Art

With fractional ownership, collectors can invest smaller amounts in high-value pieces. This democratizes access to art that was once deemed exclusive to wealthy individuals.

2. Liquidity

Tokenized artworks can be more liquid than traditional art investments. Collectors can buy and sell their shares more readily on secondary markets, enhancing the art’s potential as an investment.

Challenges of Tokenization in the Art Industry

Legal and Regulatory Issues

Navigating the legal landscape surrounding tokenization can be complicated. Questions about copyright, ownership rights, and tax implications need to be carefully considered. Legal frameworks are still evolving to catch up with the technological advancements of blockchain.

Market Volatility

The art market can be unpredictable. While tokenization offers new investment avenues, it does not guarantee stability. Investors must remain aware of the risks associated with art as a volatile asset class.

Fraud and Authenticity Concerns

Although blockchain enhances provenance, it does not eliminate the risk of fraud entirely. For instance, if a fake artwork is tokenized, the digital record will reflect ownership of a non-existent piece. It is essential to perform due diligence before investing in tokenized art.

The Future of Art Tokenization

Innovations on the Horizon

As technology evolves, the art world stands on the brink of a transformation. Innovations such as augmented reality (AR) and virtual reality (VR) could augment the experience of owning tokenized art, providing immersive experiences for collectors.

Integration with Other Technologies

The combination of tokenization with artificial intelligence (AI) could lead to more effective valuation techniques and personalized recommendations for collectors.

The Rise of NFT Art

Non-fungible tokens (NFTs) have already made a significant impact in the art world, with digital artists selling works for millions of dollars. The intersection of tokenization and NFTs might lead to even more diverse investment opportunities.

Conclusion

As the tokenization of art continues to unfold, it offers exciting possibilities for both artists and collectors. While challenges remain, the potential for redefining ownership and investment in the art world is significant. The future is bright for those willing to embrace this innovative approach to art ownership.